A legislative amendment concerning the taxation of vouchers in the EU entered into force in 2019. The amendment affects all companies that issue gift certificates.

Although the legislation will now differentiate between single-purpose and multi-purpose vouchers, the process for issuing vouchers will not be affected. However, taxation of vouchers will change as follows: single-purpose vouchers will be taxed upon sale; multi-purpose vouchers will be taxed when the goods or services to which the voucher relates are supplied.

The amendment only concerns single-purpose vouchers. A single-purpose voucher is a voucher where the place of supply of the goods or services to which the voucher relates, and the VAT due on those goods or services, are known at the time the voucher is issued. Such vouchers are issued by the taxable person, who can calculate the VAT upon transfer. Single-purpose vouchers are issued in relation to the provision of a single specific product or service. The owner of this type of voucher can only use it to buy a certain product or service (e.g. the gift card of a restaurant, tanning salon or massage parlour).

The amendment affects the time of supply of single-purpose vouchers. As such, the time of transfer will now be regarded as the time of supply instead of the supply of the goods or services related to the voucher. This means that VAT is paid for each sold voucher, even if the voucher is never used.

The amendment does not affect multi-purpose vouchers. A multi-purpose voucher is any voucher where the exact goods or services, nor the VAT due on those goods or services, are known at the time the voucher is issued. Such vouchers may include book shop vouchers – the VAT due for the goods isn’t known because the store sells both reduced and standard rate goods. Or the voucher of a hotel chain that allows the holder to pay for accommodation or catering at any of the chain’s hotels and restaurants, regardless of where these are located. A multi-purpose voucher is also a good choice for goods that may be subject to different deposits, e.g. drinks.

Multi-purpose vouchers also include vouchers transferred by a person acting in another person’s name (i.e. a mediator). The parties will then be required to conclude a contract that stipulates the distributor’s commission and requires the issuer of the voucher to pay VAT when they receive the money for the voucher.

Multi-purpose vouchers that allow the customer to choose the store and product are common in Europe. The goods or services purchased with the voucher nor the VAT due on those goods or services are known at the time the multi-purpose voucher is sold. As such, VAT for multi-purpose vouchers will continue to be paid upon the transfer of the goods or services related to the voucher.

It should also be noted that the directive does not concern vouchers that only grant the holder a discount on certain goods or services. Vouchers issued for free will also not be subject to taxation.

Discounts that are not related to a specific transaction and that grant discounts on all purchases, e.g. loyalty cards, are also not affected by the amendment.

Erply’s Recommendations for Its Customers

In essence, the directive does not bring about any drastic changes. All you really have to do, is tell the difference between single-purpose and multi-purpose vouchers. If you sell vouchers at your shop in your own name (and all your goods are subject to the same VAT rate), you are dealing with single-purpose vouchers. You will now have to calculate the due VAT for such vouchers upon their transfer.

A multi-purpose voucher, however, is a voucher you either mediate or where you don’t know the exact VAT due on the goods or services related to the voucher at the time of transfer. Or if your shop sells goods that have different VAT rates, e.g. book shops that sell both reduced rate books and souvenirs, etc.

The amendment affects vouchers issued after 1 January 2019. Vouchers issued before the directive takes effect will be subject to the previously valid rules. And if, according to the new definition, you sell single-purpose vouchers, you will now need to pay VAT on the vouchers upon their transfer.

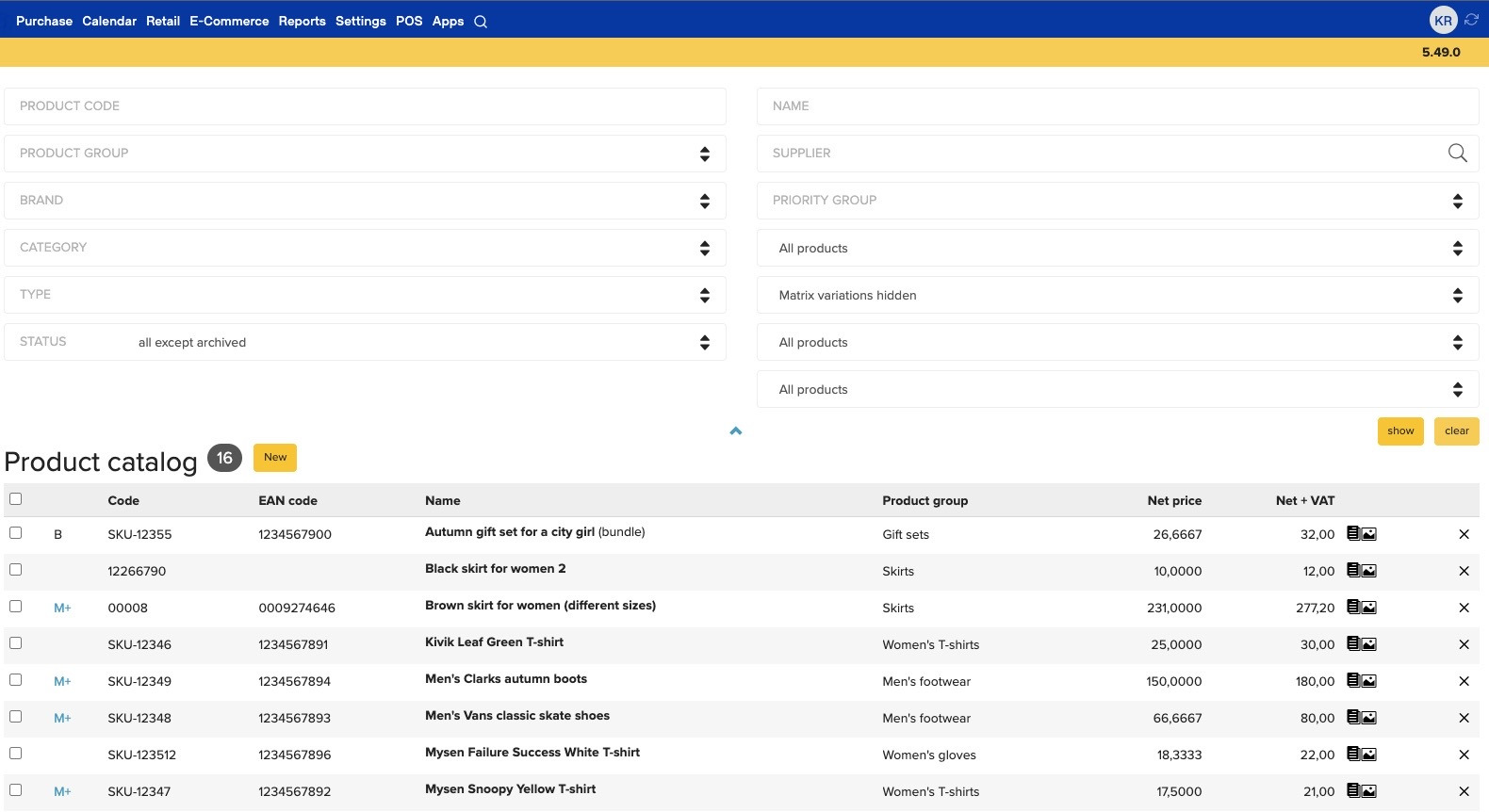

Erply has added four new settings to Settings → Configuration → Tax rates:

- Default 0% VAT rate for sales within the European Union

- Default 0% VAT rate for sales outside the European Union

- Default 0% VAT rate for tax-free products

- Default 0% VAT rate for customers exempt from tax

The first two fields only appear on EU accounts.

What Is a Voucher?

A voucher is a document that confirms an order or the payment of a fee and grants the holder the right to certain goods, services or discounts. The terms “coupon” and “gift certificate” are often used interchangeably with “voucher”.

- A voucher is any document that grants the right to certain goods or services, or to a discount or reduced fee.

- A discount voucher grants the holder a discount on certain goods; the discount may be indicated as a percentage or a fixed sum.

- A voucher may refer to a digital or physical gift certificate, calling card, entry ticket, discount coupon, electronic message, etc.

- The service provider must accept the voucher as payment for the provided goods or services.

The directive does not affect the taxation policies. This means that if the buyer makes a €100 purchase and pays 95 euros in cash and 5 with the voucher, then the seller will be taxed on the actual sum accrued, i.e. 95 euros.

How to Differentiate Between Taxable and Non-taxable Vouchers?

Some vouchers are regarded as a prepayment pursuant to legislation and are non-taxable. These include vouchers:

- Issued at a travel agent upon payment;

- Issued by a car rental company;

- Acquired when making a prepayment for a hotel room.

A taxable voucher is a voucher that has a specific value and grants the customer the right to a service or product and that also serves as advertising. A classic example of this type of voucher is a shop’s gift card that can be used to pay for goods and services.

Sign Up