Starting 1 January 2025, Estonia will implement significant changes to its VAT rates.

What’s Changing?

Accommodation Services

The VAT rate for accommodation and accommodation with breakfast will increase from 9% to 13%.

Press Publications

The VAT rate for press publications will rise again from 5% to 9%.

Cash Accounting VAT Scheme Adjustments

For businesses using the cash-based VAT accounting scheme, transitional provisions will apply until 31 December 2026.

Accommodation Services:

If the invoice was issued, and the service provided before 1 January 2025, the VAT rate of 9% can still be applied to payments received afterward.

Press Publications:

If the invoice was issued, and the publication (physical or electronic) was made available before 1 January 2025, the VAT rate of 5% can still be applied to payments received afterward.

Key Takeaways

Prepare for these changes and ensure accurate invoicing and service delivery dates to benefit from the transitional provisions.

How to Change VAT Rates in Erply?

Starting January 1, 2025, significant changes will be made to VAT rates. Here's a simple guide to update them in Erply:

Step-by-Step Instructions

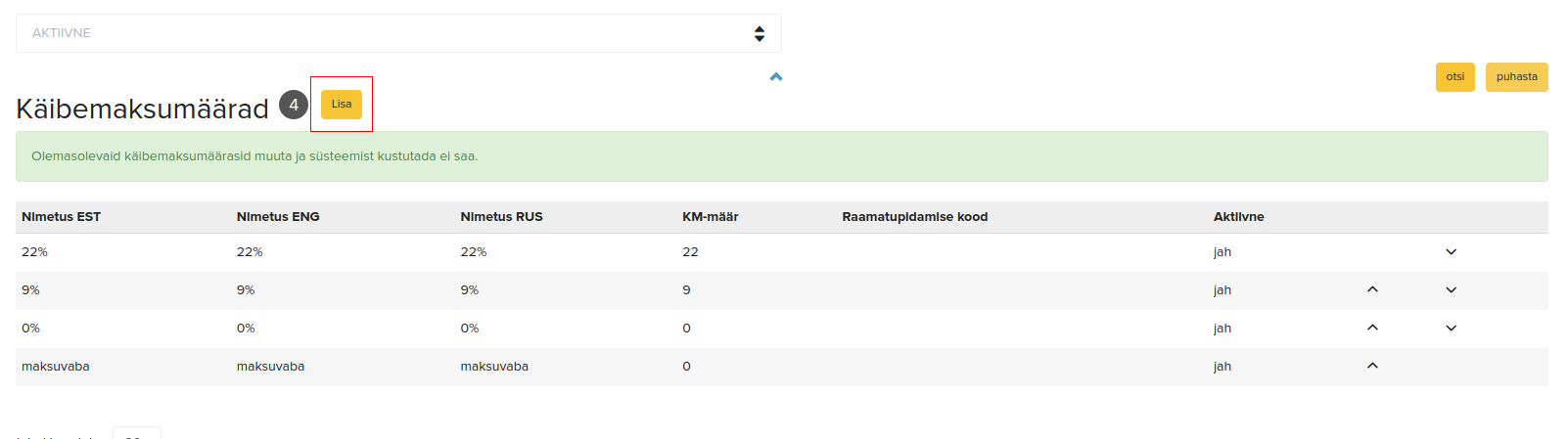

- Access VAT Settings:

- Go to the “Sales” category in Erply.

- From the submenu, select “Set Up VAT Rates”.

Add a New VAT Rate:

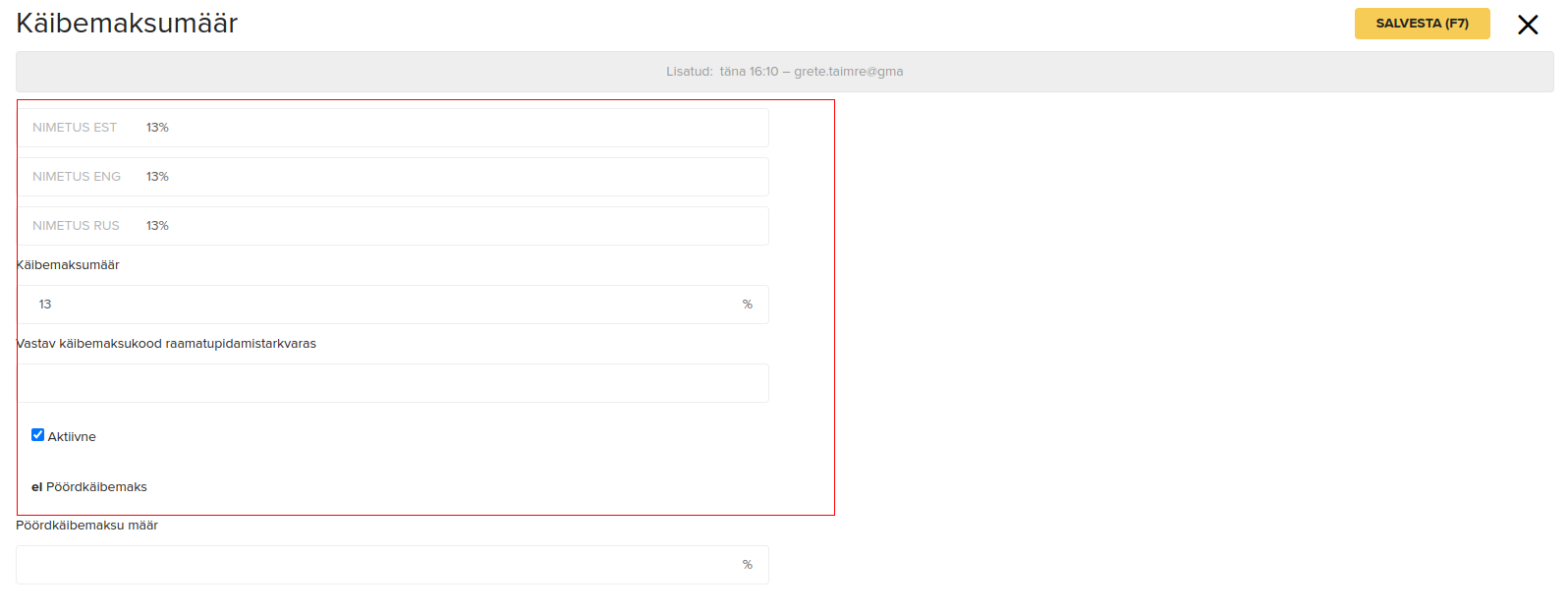

- Click on “Add New VAT Rate”.

- In the new window, enter the new VAT rate (e.g., 13% or 9%) as required.

- Note: Do not fill in the Reverse VAT Rate field.

___________________________________________________

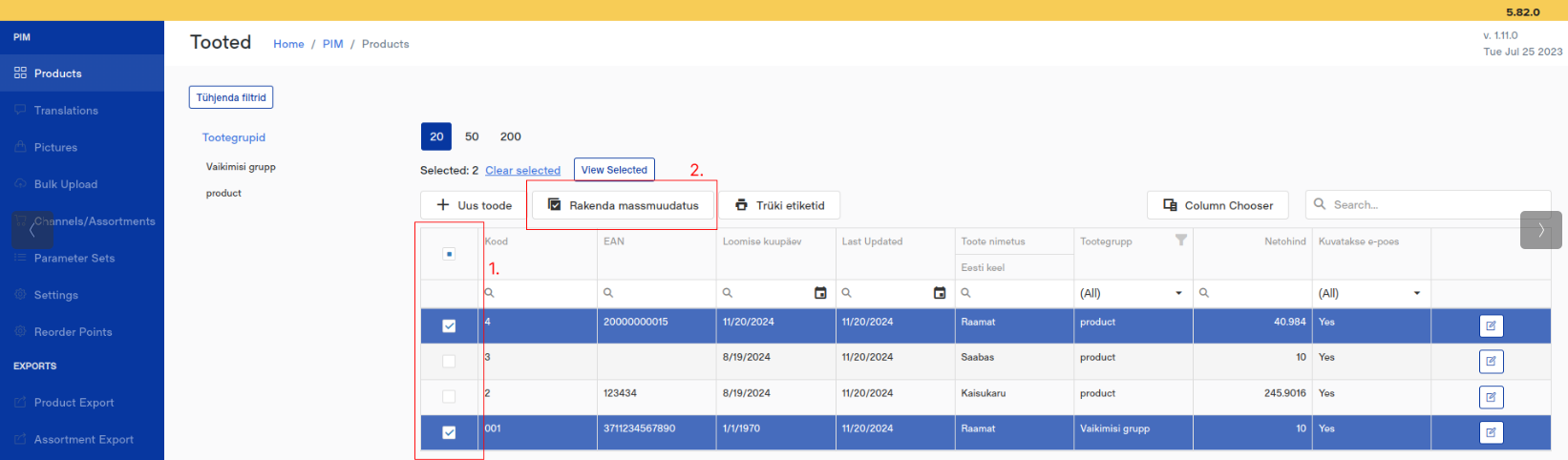

Update Products in Bulk Using the New PIM System:

- Open the PIM system to manage products.

- Select the products you want to update and click “Apply Mass Change”.

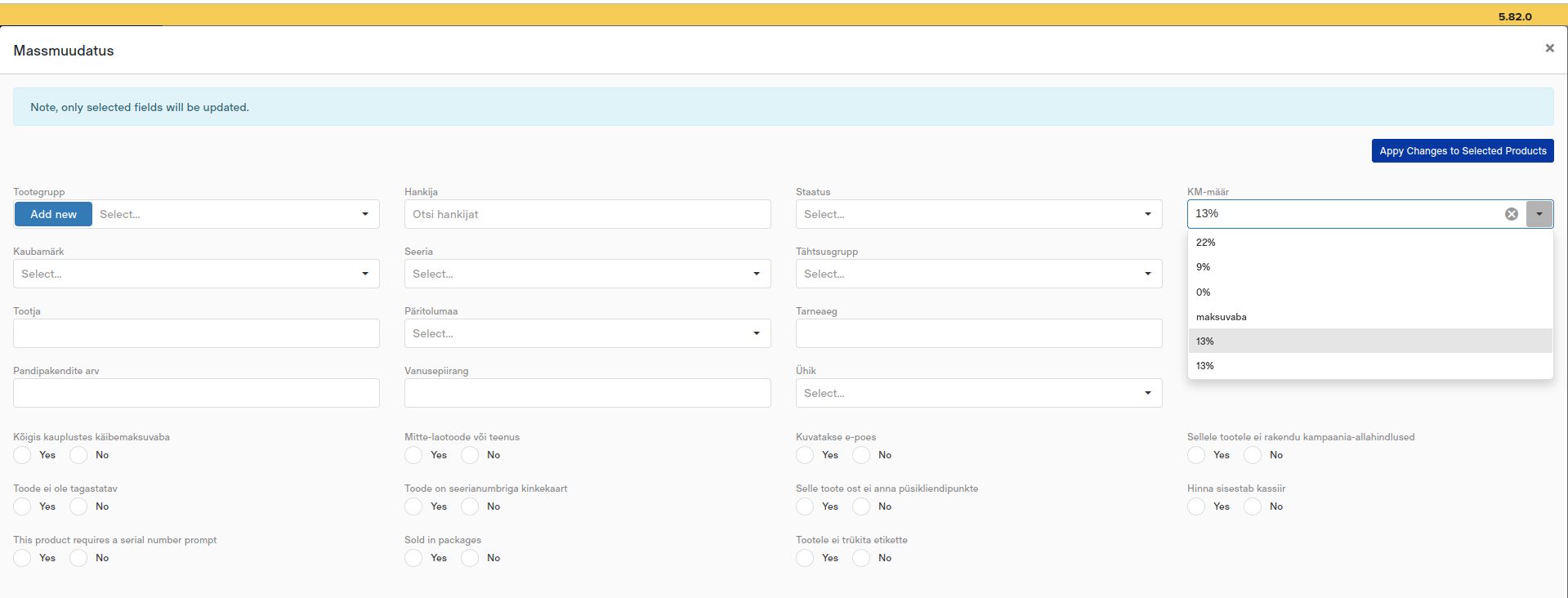

Apply the VAT Rate:

- From the mass change options, find “VAT Rate”.

- Choose the appropriate percentage (e.g., 13% or 9%).

- Click “Apply Changes to Selected Products”.

And that's it! You have successfully updated the VAT rate for your selected products.

If you have further questions about using Erply, feel free to email us at abi@erply.com. Our customer support is available Monday to Friday, 9:00–17:00.

Good luck, and happy selling! ?